Just like everything else, real estate is becoming more expensive. I know that’s not something everyone looks at favorably, but overall, it’s a positive. The housing market is still thriving, but more homebuyers are finally able to get into homes after 3 years of competing against everyone and their brother. This doesn’t mean that seller’s aren’t getting great prices for their homes, it just means that we aren’t seeing two dozen offers on every house. Why the change?

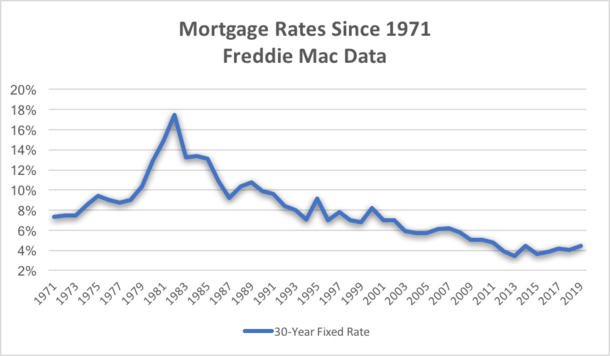

When 2022 started, interest rates were in the 3-4% range. This allowed homebuyers to purchase homes while paying minimal interest on their loans. Although this has been the norm for interest rates over the last 10-12 years, this has not been the norm historically. Anyone who purchased a home before 2008 can back that up.

If you purchased a home in the 80’s, these last 10-12 years have felt like a dream, I’m sure. If you didn’t purchase your first home until 2010 or later, you’re probably freaking out about the rates! Don’t fret. Buying a home is still so much better than renting or living uncomfortably. And undoubtably, rates will come down again in the future. That means that when they do, you can refinance your loan to a lower rate. If the rates are making you pause about making your next move, what’s the cost of staying where you are?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link