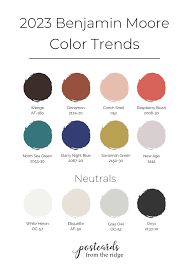

As the world of fashion and design continues to evolve, so do the trends in color. While some colors are timeless, others come and go with the changing seasons and years. As we look ahead to 2023, we can expect to see certain color trends emerging.

Pastels? Let’s Talk 2023 Color Trends

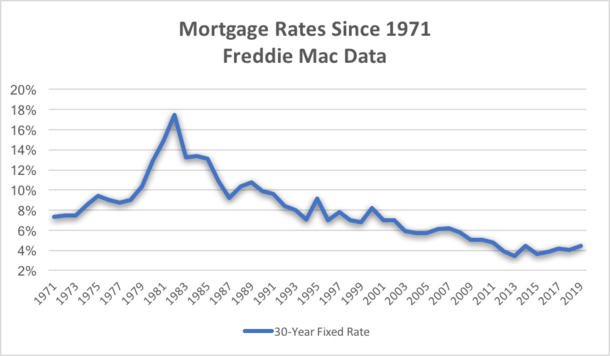

Steps To Getting A Mortgage

Are you looking to get a mortgage for a new home? It can be a daunting process, but it doesn’t have to be. Here are some tips on how to get a mortgage.

Home Staging When Selling Your Home

Home staging is a crucial step in the process of selling a home. It is the process of preparing a home for sale by making it look more attractive to potential buyers. Home staging involves rearranging furniture, removing personal items, and making minor repairs and improvements to increase the appeal of the home.

Home staging is a great way to make a home look more attractive and appealing to potential buyers. By making minor repairs and improvements, arranging furniture, and adding decor and accessories, it can help to increase the sale price and reduce the amount of time a home is on the market.

What’s In Store for 2023?

Pennsylvania’s real estate market is expected to remain strong over the next few years. The state’s economy is expected to continue to grow, and with it, the demand for housing. The state’s population is projected to increase by 1.3% each year through 2023, which will create even more demand for housing. Additionally, the state’s unemployment rate has been decreasing, and the job market is expected to remain strong. This will create more people looking to buy homes, which will drive up prices.

The median home price in Pennsylvania is expected to increase by 2.4% each year through 2023. This is due to the combination of increasing demand and limited supply. With the population growth, there is a need for more homes, but the state’s housing supply is limited. This will lead to an increase in prices as demand outpaces supply.

Overall, Pennsylvania’s real estate market is expected to remain strong over the next few years. The combination of increasing demand, limited supply, and tax incentives will help to drive up prices and make it a favorable place to buy a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link